Our financial structuring capabilities are based on extensive structuring experience gained in the corporate finance and project finance sectors in the Brazil

- M&A

- Joint Ventures

- Financial Restructuring

- Project Finance

- Structured Finance

- Private Equity and Debt

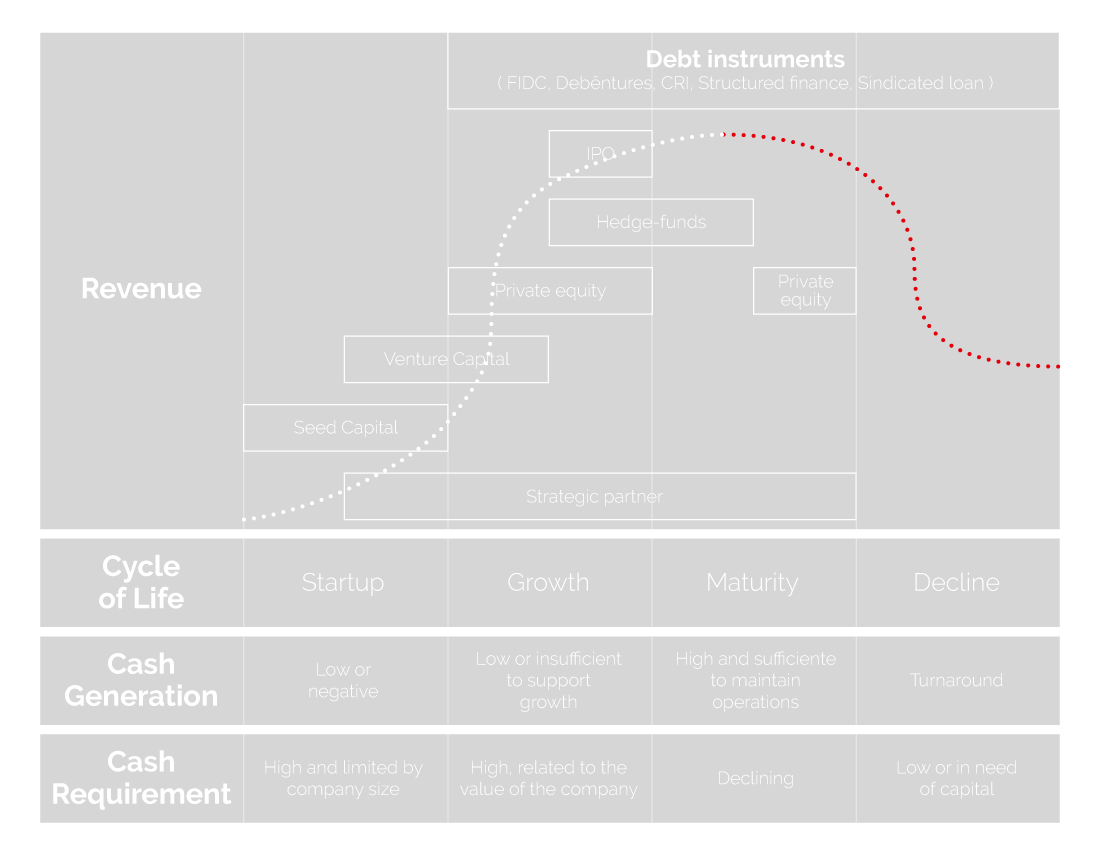

Our holistic approach to financial structuring includes fiscal, legal, business and financial aspects of relevance to the client aiming at an optimization the client´s financial structure, including a wide range of financial products such as:

- Equity

- Preferred Equity

- Mezzanine

- Convertible Bonds

- Bonds

- Straight Debt

- Debentures

- FIDC

- FII

Transactions are structured on the basis of three fundamental principles: value maximization, risk management and market segmentation.

Value Creation

Creation of value for the client and the company´s shareholders is the ultimate objective of any assignment. This goal is achieved by assisting the client in the selection of the optimal business or development strategy for both immediate and long term goals.

Risk Management

Risk is healthy if remunerated with the appropriate return. The three main areas of risk are operational, credit and market. From the risk management perspective, PLANNING´s professionals have the experience to identify, analyze and structure to mitigate existing and foreseeable risks associated with a given deal, in this way protecting shareholders and lenders from possible future pitfalls.

Market Segmentation

Transactions are structured following our reading of the markets from an overall perspective, but also taking into account relevant market segments. Investor and lender appetites for risks and returns, as well as for specific industries and markets are key factors that are analyzed, assessed, and incorporated into the structuring and the strategic positioning of the transactions.